Optimize Portfolio of 7 Stocks That Outperform in a Recession

In this article, we took the list of stocks recommended by US News and World Report that may outperform in a recession and ran it through RichKat to determine the efficent portfolios. That is for any given risk, what is the best expected return we should expect from our seven stock portfolio. The seven stocks are:

Walmart Inc. (WMT)

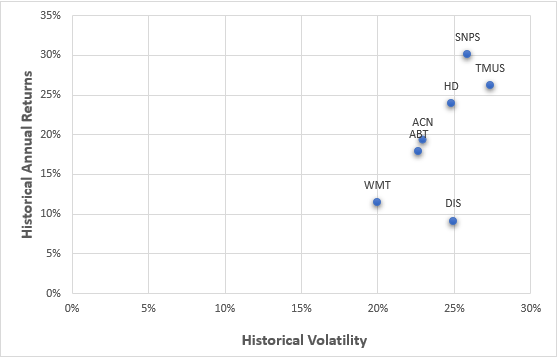

First here is a look at the individual stock’s risks and returns:

As you can see, Synopsys Inc. has significantly outperformed Disney and Home Depot in terms of returns, including dividends, with only slightly higher volatility. Comparing Walmart and Disney, Walmart for the past ten years slightly outperformed Disney but with much lower volatility. Abbott Laboratories and Accenture performed similarly. Lets take a look at how they are correlated to see if there’s any value in having both stocks in your portfolio.

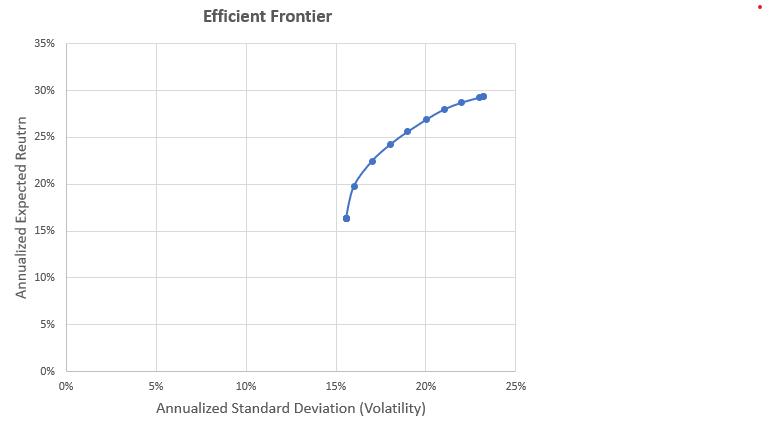

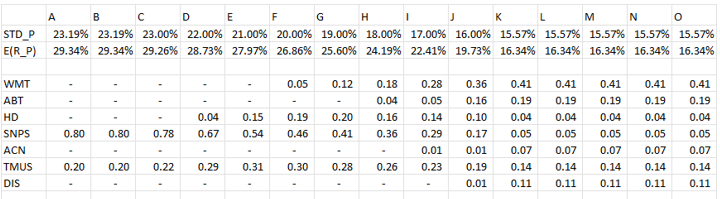

Using RichKat, we determined the Efficient Curve (shown on the right). The Efficient Curve depicts the optimal risk to reward relationship. For example, if you want to build a portfolio from the seven stocks recommended by US News & World Report and want the lowest possible volatility (15.57%), you should expect a return of 16.34% and only hold two stocks, 80% SNPS and 20% TMUS. Conversely, if you want to build the highest possible return portfolio, what risk should you expect? The answer is the right tip of the curve which shows a volatility of 23.19% and an expected return of 29.34%. The “optimal” portfolio as indicated by the largest Sharpe ratio (1.243) is a portfolio with expected return of 26.86% and a volatility of 20%. (All data referenced in this paragraph shown in the table below).

(Curious to see how volatility affects your portfolio, click here.)

In addition to stock returns and volatility, correlation is another element that is needed to optimize the portfolio. Modern Portfolio Theory uses correlation coefficients between the returns of various assets or stocks in order to strategically select those that are less likely to lose value at the same time. That means determining to what extent the prices of the assets or stocks tend to move in the same direction in response to macroeconomic trends.

Let’s look at how each of the seven stocks correlate to one another. Looking at the correlation table in RichKat, we can see that Walmart and T-Mobile are not highly correlated (low percentage), which in terms of balancing a portfolio is a good thing. Conversely, we can also see that Synopsys inc. and Accenture are somewhat correlated (highest percentage in the correlation table).