Correlation - When two sets of data, in our case, stock prices are strongly linked together we say they have a high correlation. A positive correlation is when two stocks move together in tandem, i.e., when one goes up, so does the other. A negative correlation is when two stocks move in opposite direction, i.e., when one stock goes up, the other goes down.

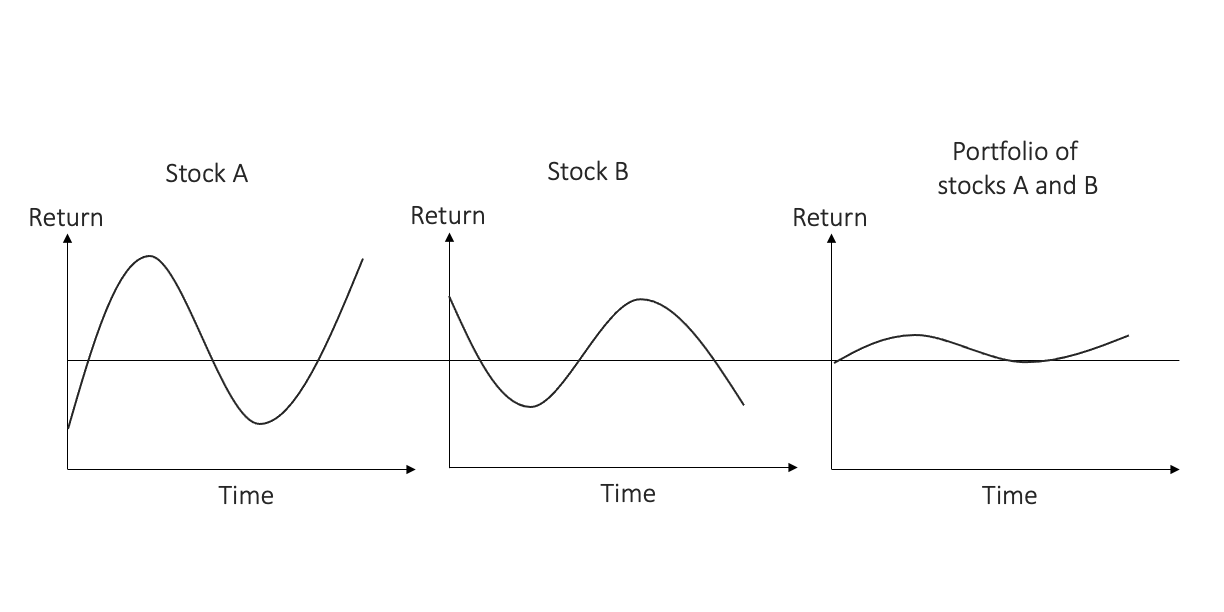

Correlation plays a huge part in the Modern Portfolio Theory - it’s the critical component needed to lower volatility. For example, if you have a portfolio consisting of two stocks that are perfectly negatively correlated (stock A & stock B), your resulting portfolio return will have a much milder swing as shown below.

Stock A and stock B are highly

volatile assets and negatively

correlated. Together, they offset

each other, resulting in a lower

volatility portfolio.

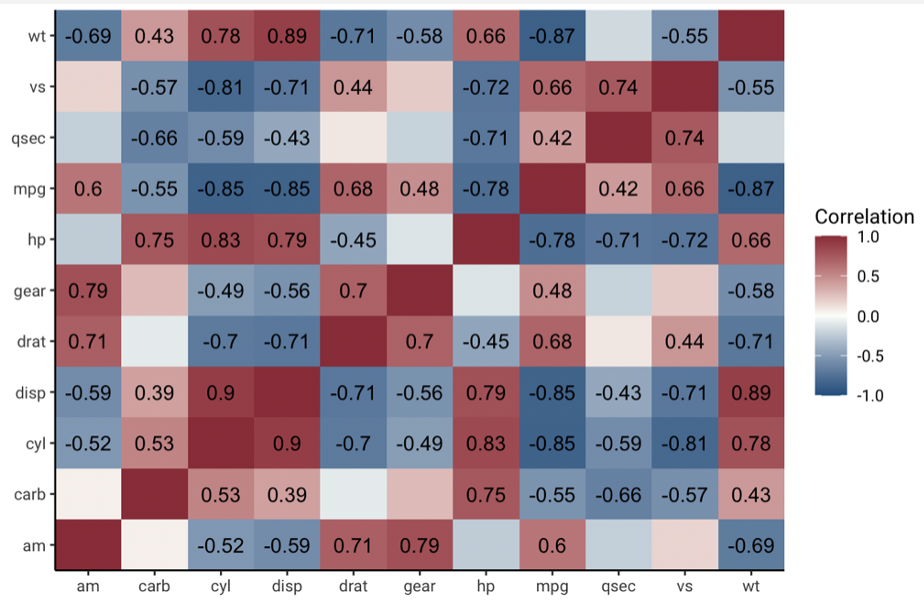

Ready to find out how your stocks are correlated? RichKat’s correlation heat map will allow you to see how your stocks are correlated in a simple visualization model. You’ll be able to quickly identify which stocks are contributing to lowering volatility or it may be the case that you don’t have enough diversification. Either way, you’ll have the information needed to balance your portfolio in a meaningful way.

Correlation Heat

Map allows you to

quickly see how

any one stock is

correlated to

another stock.

Low Correlation Boost - In case you need another reason - most investors understand that adding low correlation returns to a portfolio will reduce portfolio risk. However, very few appreciate how much low correlation assets can improve the overall portfolio return. The return enhancement comes from the annual rebalancing from the outperforming investment to the underperforming one. Since the two uncorrelated assets produce comparable long-term returns through very different paths, the repeated buy-low and sell-high discipline accrues over time. We call this hidden benefit the “low correlation boost.” The lower the correlation the greater the boost potential because of the increased dispersion of returns between the two investments. This is a well-known and widely documented phenomenon(1) that is commonly overlooked.

1 One example of a long-standing research article on the subject is Bernstein, William J. “The Rebalancing Bonus: Theory and Practice.” Efficient Frontier: An Online Journal of Practical Asset Allocation. September 1996. http://www.efficientfrontier.com/ef/996/rebal.htm.